Quantitative Trading Based on AlphaNet

Predict stock return with AlphaNet and Transformer

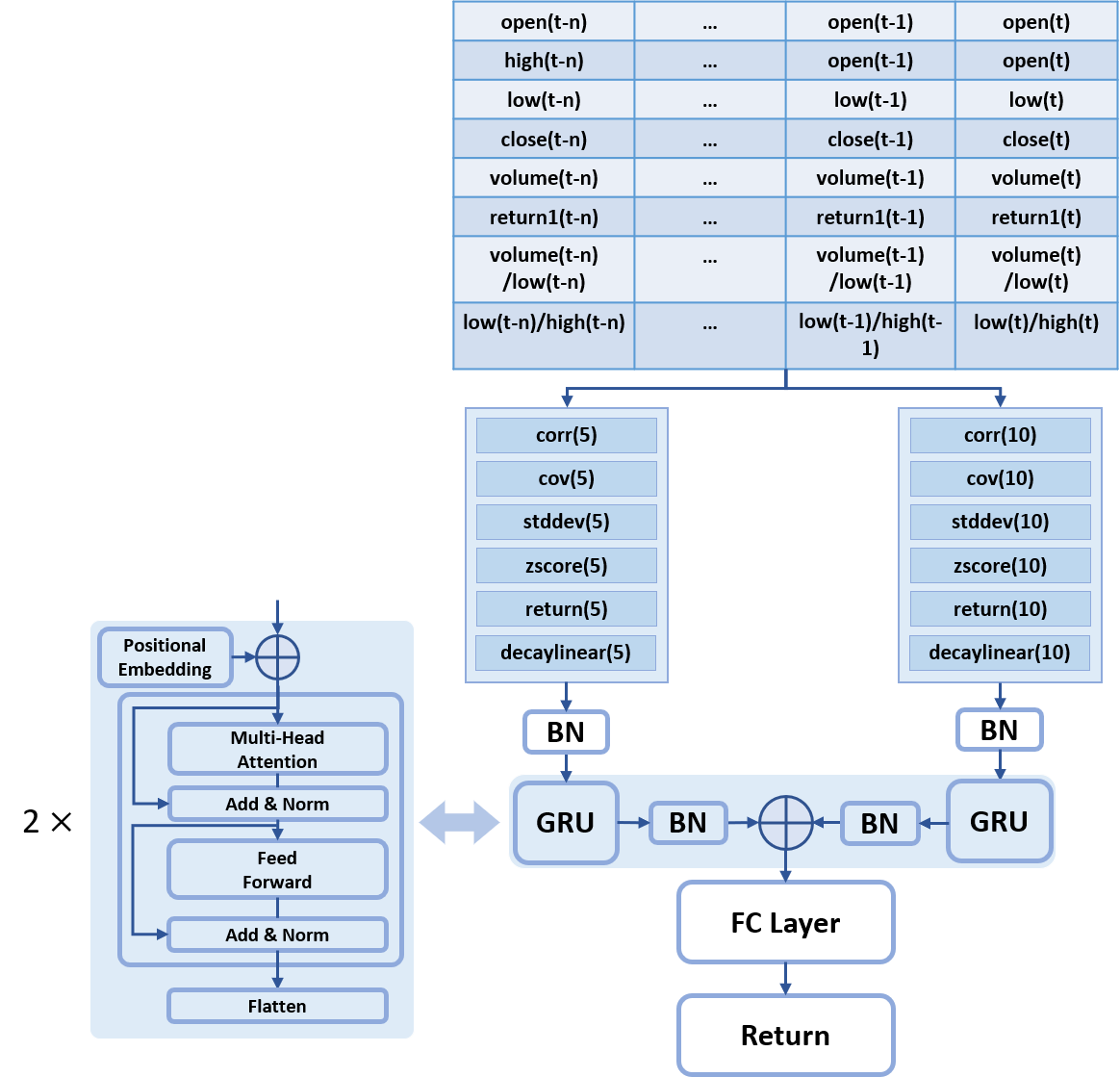

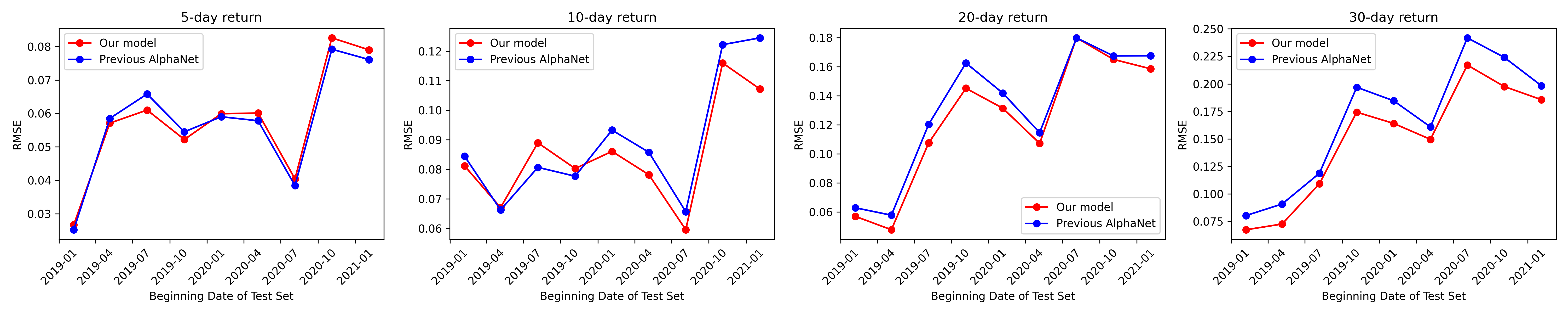

In recent years, many machine learning algorithms have been successfully applied in the field of quantitative trading. However, most of them are multi-step methods, which means manual intervention is required by them. As end-to-end methods, deep learning models can overcome this shortcoming. Combined with GRU, the AlphaNet has been applied in quantitative trading and achieves good performance on some datasets. Motivated by attention based Transformer which has outperformed recurrent models like LSTM and GRU on many sequence processing tasks, we would like to replace AlphaNet’s GRU with Transformer to improve model’s performance on stock return prediction. Experiment results show that our model performs better than previous AlphaNet on both RMSE in return prediction and profits making in backtest. We also did analysis for history length and ablation experiments.